I have been running a lower mid-market investor backed business acquisition firm (search fund for those in the know how). Barring a successful close of a couple of pending deals through intermediaries (investment bankers and business brokers), I’m inclined to moving on towards other endeavors. This post is a collection of my lessons learned through running a search fund along with some of the current M&A and market dynamics in the lower mid-market space.

Business buyers in the lower mid-market segment run across the entire gamut of private equity funds, family offices, independent sponsors, search funds with investors, and search funds that are self funded. There could be other buyer profiles that I may have missed. I have not explained what/whom these buying entities are, please look it up separately. This post is about my lessons learned as an investor backed search fund buyer in the current lower mid-market segment.

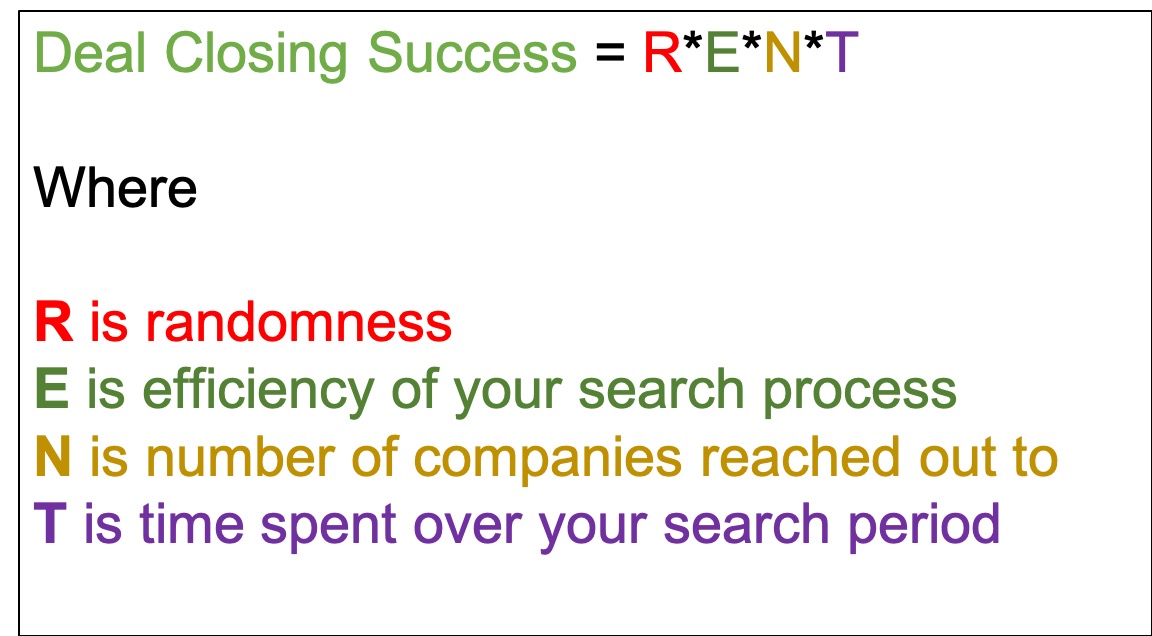

I’m largely math and data driven, so I see the success of closing a deal in the form of the equation below

Assuming you are diligent about asking+following advice from your investors (more on that below), and are also following standard best practices, efficiency (E from above) is usually within a narrow range even among a large statistical pool of searchers. The positive variation of efficiency over time (T from above) is also consistent within a narrow range. This brings us to the next two variables – randomness and number of companies. There is significant inherent randomness in the process because no matter how efficient a searcher is, she/he needs to be at the right place and at the right time. This makes the search process a probabilistic outcome beyond our full control. I see this as the equivalent of finding street parking in Manhattan on a busy Saturday evening. No matter how diligent we are, we have to be at the right place at the right time.

Mathematically, one of the best ways to counter randomness is increasing the sample size (N in our equation above). This means increasing the number of companies we reach out to in the context of our search to counter the probabilistic volatility. This should be in balance though because the last thing you want is for ‘N’ to be so high that you are boiling the ocean in terms of companies and industry segments. With the above in mind, the following are a mixed collection of DOs and DONTs in no particular order based on my learnings.

Disclaimer: You can do everything below and some more but still not find a deal, conversely you can do almost none of these and yet find a deal within weeks of launching your search – thank you probability! The pointers below are not in the context of searchers whose outcomes are statistical anomalies but for searchers in the median group.

1. Don’t be too shy to ask your investor group for feedback. This is important and hence I’m adding this first. Asking for advice, receiving it well, and adjusting your process accordingly are all important in terms of your ROI. Your investor group and other mentors (who may not be part of your cap table) have probably seen multiple searchers and have a much wider data point. They can offer timely inputs on what works and more importantly, what may not work. Why make mistakes and then learn when you can learn from someone else’s mistakes? All of the investors I have been communicating with have provided timely help.

2. Remain in regular conversations with your investors and not just reach out when you have questions. This can help you stay abreast of other deals, what is market now for deal terms, what works and what does not etc. I’m thankful to the wonderful folks at Aspect investors to have initiated this regular monthly check ins with me themselves. B.A. Cullum, Brad Buser, and Andy Love have all been exceptionally helpful during the entire search process.

3. Start regular investor updates (slide deck) right away with comprehensive updates of your deals, search process, outcomes etc. Ideally do this monthly for the first 2-3 months to get good investor advice early on, and to settle into an investor update template that works for you. Shift this into a quarterly update after the first few months. I was fortunate to have positive feedback and helpful advice from Blake Winchell and Peter Schober regarding this early on.

4. Negotiate every expense item in your search fund. This includes your office rent, internet, all of the tech tools, freelancers, etc. Minimizing your expenses (recurring and non-recurring) will help extend the runway. Getting comfortable with the awkwardness of asking for such discounts early on will help later with any perceived awkwardness during deal terms negotiations

5. Plan early to extend the search runway as much as you can. Conversations with searchers having successful deal closings made me realize that it came down to a few months’ difference for them.

6. Understand that there are three buckets of skills for a searcher – sales (deal finding), M&A (deal making), and operations. To be successful, you must already be proficient in any two out of these three. Understand your strong areas and have a plan for your skill gaps.

7. Remember the power of options. When you have multiple deals in your pipeline, you approach each deal in a more objective manner. If you happen to have only one deal then you would want to make it work somehow and may risk buying a bad company.

8. Don’t be gun shy of making offers. The key here is to get to a valuation discussion as quickly as possible and see if there are any major gaps between seller’s expectation and what you can offer. Doing too much analysis before you get to this conversation will result in waste of time. Once you have made enough offers and have analyzed enough deals you will have a good idea of what works and what does not. The sooner you get to a valuation discussion with a seller the more efficient your process is.

9. Focus on recruiting good interns early on and train them with the outreach, research and due diligence processes. Keep your interns motivated by helping them with their career and through good references. Involve them in due diligence and empower the well trained interns with outreach phone calls. Create team leads among your interns and involve the team leads in the recruitment for new interns. Good interns hire more good interns. I was fortunate to have an excellent roster of 25+ interns. After my first two batches, I was involved only in the final interview for the subsequent hires. My team leads and other interns handled the prospecting and initial interviews. We also had an active Slack group where all of the interns communicated their work and also helped each other for their career next steps after they moved on. Measure your interns by quantifiable outcomes and not by time in the office.

10. Remain aware of where you stand among other types of lower mid-market business buyers. As an investor backed search fund, your cost of capital is definitely higher than strategic buyers, PE funds, family offices, and maybe even independent sponsors and self funded searchers. Their lower cost of capital means they can outbid you in deals (and can probably still achieve the same targeted returns). Being aware of this is important because in a brokered deal if there are other buyers like PEs or strategics then it is better not to spend too much time in that deal unless the seller likes us for personal reasons (which is too rare these days). Understand that if you are still winning the deal away from such other buyers especially for $2M+ EBITDA businesses, chances are that you have either overpaid (winner’s curse?) or that you did not uncover a crucial issue in the deal.

11. Understand how you as a buyer can create financial value for your investors and for yourself through the deal. This is also related to the cost of capital mentioned above. Generally, there are two ways of creating financial alpha through leveraged buyout type acquisitions – by EBITDA expansion or by using leverage (debt) where the equity component is much lower so long as the cashflow can support servicing higher debt. As a traditional funded searcher with expensive preferred shares in your cap table and debt options also being expensive, creating financial alpha primarily through leverage becomes more difficult. Growing revenue while maintaining good operational efficiency and having corresponding EBITDA growth is one of the most proven ways of creating financial alpha for all stakeholders in the deal. While deal finding and deal making are important, the crucial piece is your operational expertise to make money out of the deal. Realizing this is important since it has a direct effect on your choice of industries to search in. Do I know this industry well? Do I feel passionate about this industry? Can I learn this quickly? Do I see myself running a company in this industry for 7+ years while still maintaining my initial level of interest? – All of these are important questions to address early on when picking industry segments. I’m thankful to have learned about post search operations, its challenges and the best practices from Mike Rozenfeld who is also in the Redwood Growth Partners cap table. Understanding operational practices (especially money management in a debt focused acquisition) can be helpful and I loved the book The Outsiders by Will Thorndike for this.

12. Understand investors’ geographic and industry preferences. Some investors may have preferences towards certain geographies or industries. Geographic preferences are straightforward enough to identify. Do ensure that your investors share your vision for your industries of interest. For instance, if you are looking at SaaS businesses and are open to more than 5x ARR in valuation because you believe strongly in projected revenue growth for that sub-industry, then it may not be a fit with some of your investors even if they are open to tech businesses. Dig a little deeper to understand your own preferences and have more in depth corresponding conversations with investors early on. I was fortunate to understand the nuances of this early on through a conversation with Craig Jones at TPE Boulder.

13. Research industry segments and understand why they may be good for you. An industry that is good for you may not be good for me. Given your career experience, your skills, and your interests, an industry that is not good for me may be perfect for you. Make sure your industry research also includes a deep understanding of your own strengths and weaknesses. An early conversation with Doug Tudor helped me understand this better.

14. Don’t underestimate sellers. This is in the context of trying to buy a company for below market value. The days of information arbitrage where a seller may not realize the true value of her/his business are long gone. Almost all sellers are well informed of the current market dynamics in their segments. If your strategy for creating financial alpha is primarily centered around buying something cheap (deal finding and deal making) then it may not be successful.

15. Understand the balance between high volume and focused search strategies. You need high volume to counter randomness. At the same time, you should not boil the ocean and target many industry segments. You risk being constantly on the learning curve when analyzing companies, and you also risk not giving due attention to the operational aspects of running the company. I was fortunate to learn the disadvantages of high volume search from a conversation with Coley Andrews of Pacific Lake Partners.

16. Learn effective ways to present deals to your investor group especially in the post IOI or post LOI stages. Put enough emphasis on risks and mitigation plans. Among other aspects of a deal, a common area is revenue growth and I like breaking my post acquisition growth strategies across 4 areas

- Selling the same product/service to new customers within the same segment

- Selling the same product/service to new customer segments (green field opportunities)

- Selling new product/service to existing customers

- Selling new product/service to new customers (moonshots and not immediately applicable)

I am thankful to have learned about this and many other things across the entire search journey from Mahesh Rajasekharan.

17. Present prospective deals to investors in a clear and consistent manner. This not only makes it easier for you to present multiple deals over time, it also helps your investor base catch any potential issues early on (and thus help kill a bad deal quicker). I have been very appreciative of the entire team at Relay Investments for their diligence when I present them with deals. I’m equally appreciative of M-K O’Connell and Shaun Rader of M2O, TTCER, and Tushar Shah for immediately making time for phone meetings and for providing me with timely advice every time I had a deal. Industry insights from Brad Brown of Applied Equity and operational insights from Ted McCarthy were helpful. In essence, make it easier for investors to help you by presenting deals in a clear manner.

18. Remain in regular contact with investors who may not be in your original cap table. This proved exceptionally helpful towards getting additional perspectives and also towards getting industry specific insights for a deal. Lew Davies and the team at Cambria Group made time to provide insights when I had a deal, so did Badge Stone of WSC & Company. Larry Dunn and Rich Augustyn from Endurance Search Partners helped me with timely feedback on my search process. I had exceptionally good help from Mark Sinatra when I was looking at deals in the PEO industry. I had a similar great help from Carlos Saez and Michael Miles of Operand Group when I was analyzing a deal in the staffing industry.

19. Understand that this is a grind and be mentally prepared for it. Unless you come from an outbound sales background, getting used to hard NOs can be challenging when prospecting a deal. Add the volatility between almost having a deal and nothing to look forward to, then it can get even tougher. Make sure you have a good support network among peer searchers and among investors during your journey. Staying in touch with peer searchers, occasional conversations (and insights) from investors like Hal Mottet, Alex Wang of Riviera Capital were helpful. I would be remiss if I do not add a special mention for the entire team at Search Fund Partners. Besides the genuine conversations and timely insights, Rich Kelley made it a point to call me every December with words of advice and encouragement.